The Volatility quality zero line is both a trend trading indicator and an indicator for volatility. It suggests the trend of the price with two colors, red and green. The green line suggests that the market is in an uptrend, while the red line suggests a downtrend. And as for its volatility duties, the farther the line is from the zero line is how much volatility there is in the market.

The indicator is a variation of the Volatility quality indicator, which was invented by Thomas Stridsman. But the Volatility quality zero line indicator differs from its source indicator in how less sensitive it is. It does not give as many signals as the source indicator, and as a result, it is more resistant to false breakouts. It uses the Open High Low Close values of a Weighted Moving Average to derive its values. On the downside, however, the market volatility indicator can be slow to react to price movements.

How to Trade Using the VQ ZeroLine Indicator

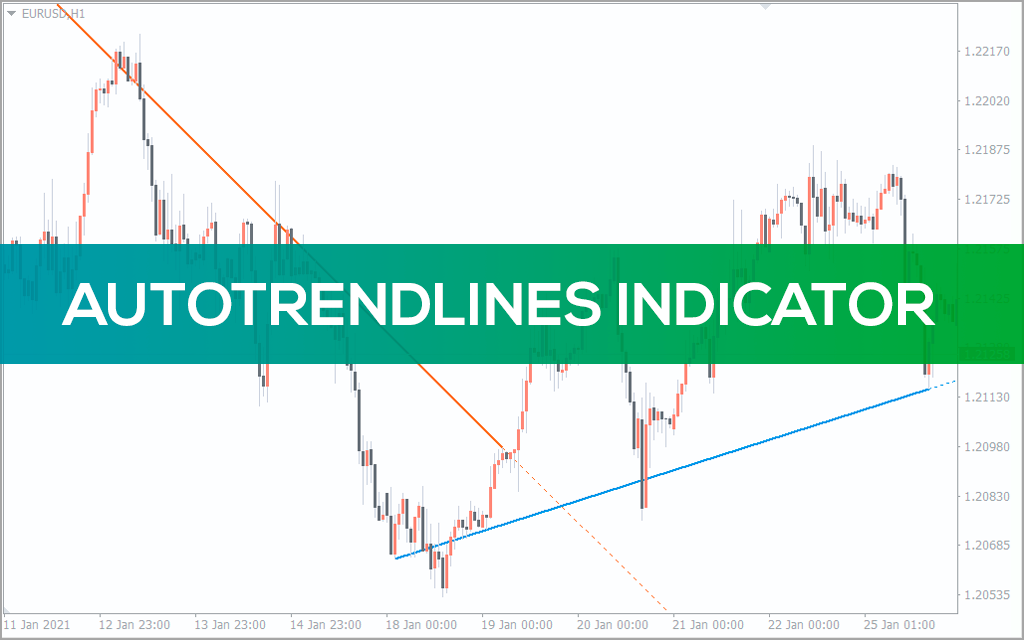

The way to trade forex using the indicator is to follow the signals. Go long when the line turns from red to green …

… and go short when the line turns from green to red.

These signals coincide with when the line crosses the zero line.

Trade Management with the Indicator

Trade entries with the Volatility quality zero line indicator is just one part of the equation. The other part is knowing how to set stop losses and take profit with the indicator.

Take profit

To set take profit levels using the indicator, exit trades at the beginning of new signals. For instance, when the volatility trading indicator goes from green to red, exit all long positions. And when the indicator goes from red to green, exit all short positions.

Stop loss

A way to set your stop loss level is to note the most recent high or low before the Volatility quality zero line indicator gives a signal. For instance, note the most recent high after the indicator changes from bullish to bearish and place your stop loss above it. This method is based on the idea that for a downtrend to occur in a financial market, there has to be lower lows and lower highs. And for an uptrend, there has to be higher highs and higher lows.

You can also use this method of setting your stop loss to filter out your trades. If you find that the most recent high or low is too far from where the new signal is, that might be a sign to not take that trade. The reason for this is that the market might have run out of momentum before you get enough pips out of the trade.

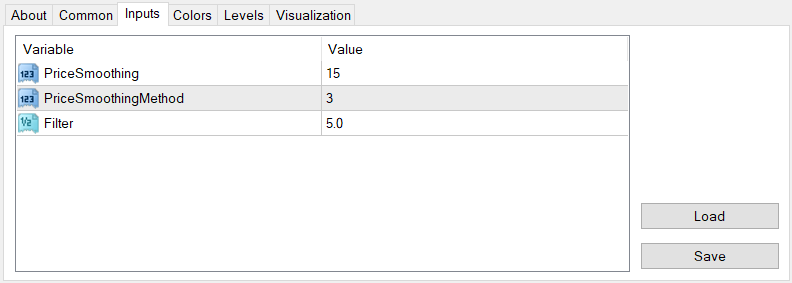

Setting

Price Smoothing: This option determines how volatile the indicator’s signals are. A higher number than the default setting, 15, gives smoother and less volatile signals. Anything lower gives more volatile signals.

Price Smoothing Method: There are only three smoothing methods on the forex volatility indicator (1,2, and 3). Setting the option to 2 gives the smoothest lines with least signals. It is best for following major trends. 1 and 3 give more frequent signals and are not as smooth as two.

Filter: The filer does almost the same job as the other two. Set the filter to higher numbers to smoothen out the indicator and get fewer signals.

Who is the Volatility Indicator Best for?

The Volatility quality zero line Indicator indicator is best for any forex trader. It is easy to use and requires no technical knowledge before you apply it to your trading.