Double Your Trading Account Forex Trading Strategy

This double your trading account forex trading strategy is a trading system that has the potential to simply do what the name says and that is double your forex trading account.

It can take a few days, a week or a few months to do that. The timeframe it takes to do that is irrelevant and its not really important. What you need to learn is how to do it.

You can do this without risking too much of your trading account.

For this to happen, you need two specific things to fall into place:

- a very strong trending market

- take multiple trades during that trend

You will always encounter times when the market is trending strongly and you may have entered at the right time and you may make a few hundred of pips in profits. Awesome…you think.

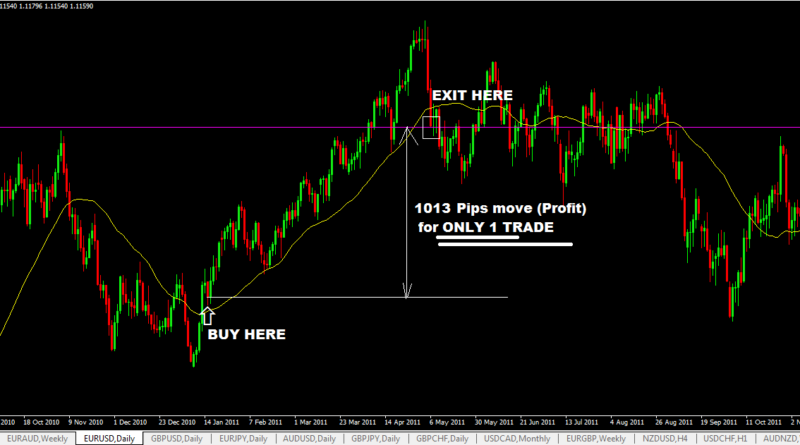

But chances are that those few hundreds of pips profit you made in that trade come only from ONE TRADE! An example would be similar to the chart below, where you only enter one trade and you make only 1013 pips profit:

But on the other hand, you could have made thousands of pips in profit in that SAME TREND move instead of just 1013 pips.

How you do that is by adding more trades and if you do that, this can happen(this is the same chart as above but in here, you are taking multiple trades along the way):

So now you can see that, taking multiple trades can increase your profits greatly and therefore double your forex trading account.

Things You Need

- Indicator: you just need the 34 simple moving average indicator.

- Timeframes: can be applied to any timeframe.

- Currency Pairs: you can use this forex system to trade any currency pairs

- The only purpose of the 34 simple moving average indicator is for telling you the trend direction.

- If a candlestick closes below the 34 simple moving average, that is considered a downtrend so you only look to sell

- If a candlestick closes above the 34 simple moving average, that is considered an uptrend so you only look to buy.

- A sell trade is initiated only when a bullish candlestick is formed in a downtrend.

- A buy trade is only initiated when a bearish candlestick is formed in an uptrend.

Short Trading Rules

- Wait for a downtrend…this happens when a candlestick closes below the 34 simple moving average.

- your first sell signal (initial sell trade signal) is that bullish (green) candlestick that forms under the 34 simple moving average and makes a higher high. This means, it must be a breakout the high of the previous candlestick.

- As soon as that candlestick closes, you open a sell market order immediately.

- Place your initial stop loss just a few pips above the nearest swing high (which is the nearest resistance level).

- For the subsequent sell trades, you do not place a stop loss.

- you exit all trades when you see a candlestick close above the 34 simple moving average.

Long Trading Rules

- Wait for an uptrend…this happens when a candlestick closes above the 34 simple moving average.

- your first buy signal (initial buy trade signal) is that bearish (red) candlestick that forms above the 34 simple moving average and makes a lower low. This means, it must be a breakout the low of the previous candlestick.

- As soon as that candlestick closes, you open a buy market order immediately.

- Place your initial stop loss just a few pips below the nearest swing low (which is the nearest support level).

- For the subsequent buy trades, you do not place a stop loss.

- you exit all trades when you see a candlestick close below the 34 simple moving average.

A Few Additional Notes

- When you take the initial first trade,you should make sure that nearest swing high or swing low that you place your initial stop loss is not too far away. The close it is, the better it is for you to move to break even and then open the subsequent trades that may come.

- ideally, any subsequent trades that you enter, you want to make sure that the FIRST TRADE CAN COVER THE COST OF THAT. What do I mean by that? Well, for example, you risk 2% of your account when you enter a buy trade and the price moves 100 pips so you move your initial stop loss to breakeven. Now you have no risk. Then you open a second trade and a third trades with no stop loss. That means, as long as these two trades do not reverse a total of 100 pips, you are still risking 2% of your account. Remember, you first trade is breakeven now. So you use the first trades profit as as buffer for the subsequent trades that follow. In that way, you do not increase your trading risk.