Have you ever wondered if there was a way to determine the strength of currencies so you could trade the pair of a strong currency and a weak one? Well, there is a way. The Currency Power Meter indicator is the way.

The Currency Power Meter Indicator

The currency power meter is an indicator that measures the individual strengths of currencies. With this knowledge, a trader can leverage the weakness and strengths of currencies to choose pairs that have the potential to be lucrative. You may also call it a currency strength indicator.

Many factors affect the strength of currencies. Some include interest rates, economies, and news. With the currency strength meter indicator, however, a trader can see the strengths of these indicators without having to do any extra computing.

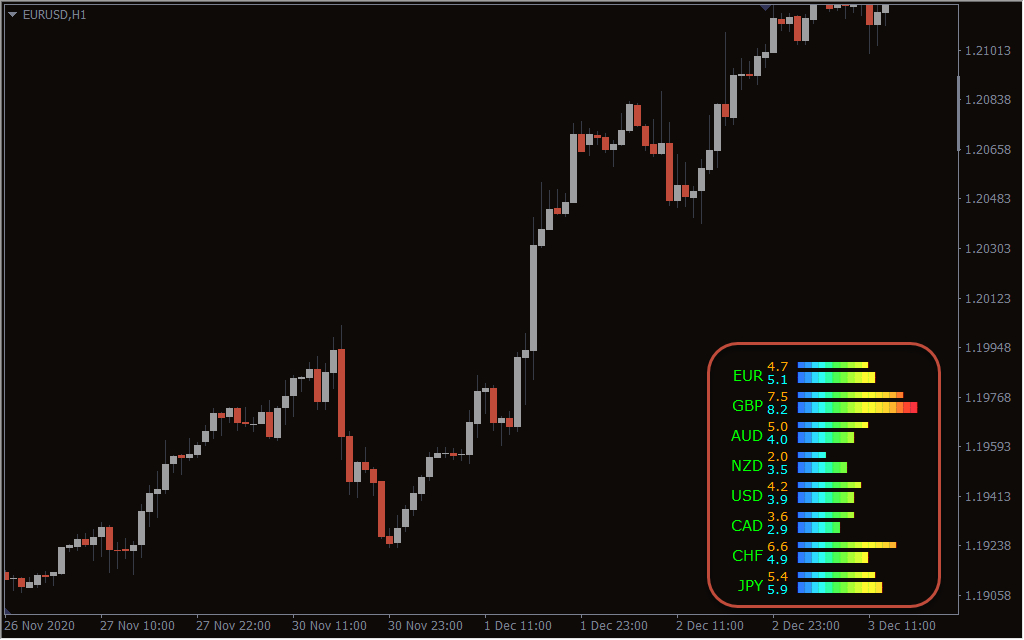

This strength determining indicator uses histograms to portray the strength of each currency. Every currency has a wide and a narrow histogram in front of it. The wide histogram depicts the currency strength on the daily chart while the narrow histogram depicts the currency strength on any other time frame you are on.

How to Use the Currency Power Meter Indicator in Your Trading

Using the currency strength indicator is simple. Load the indicator and compare the strengths of currencies. Pick a strong and a weak one. Then open the currency pair chart to look for trade entries using other forex analysis tools, such as other indicators and market structures.

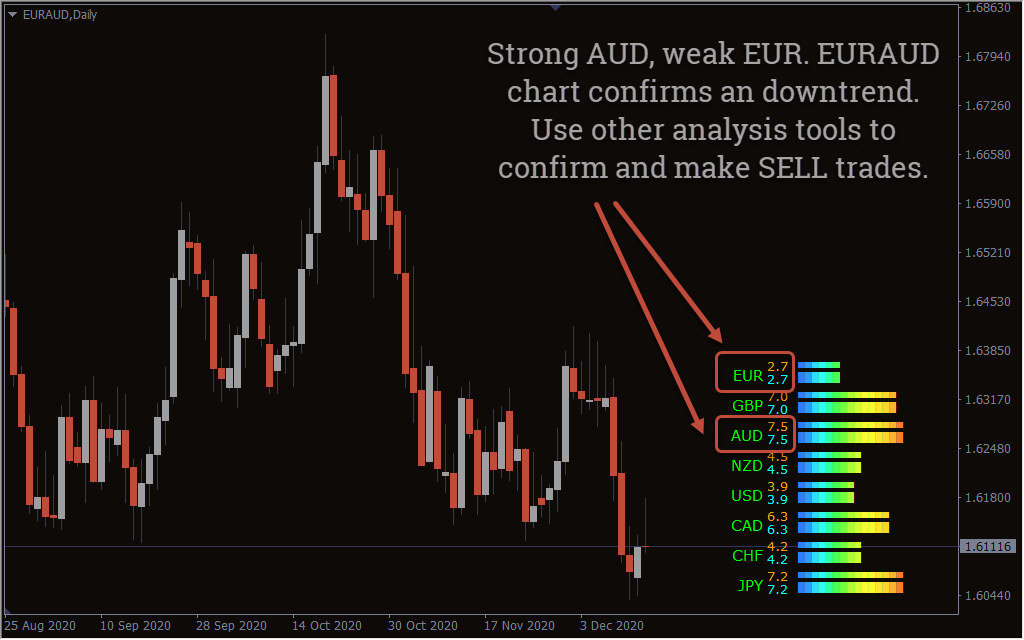

For instance, the AUD has a strength of 7.5 on the daily time frame, and the EUR has 2.7. So you are looking to trade the EURAUD in the daily or 4-hour timeframe. Because the AUD has higher strength and the EUR has a low strength, you look for sell signal on the currency pair.

So, you go to the chart, do your analysis, and be sure that your analysis agrees that you buy. Otherwise, disregard the information on the currency power meter indicator.

The Wrong Way to Use the indicator in Your Trading

Doing any of these is a misuse of the indicator:

- The currency strength indicator is not an entry or exit indicator. When you see that a currency is strong at the moment, you don’t just pair it up with a weak currency and make trades without proper analysis.

- If you are a scalper or you trade the smaller time frames, do not rely heavily on this indicator. The reason is that high-impact news is more likely to cause temporary hyper-volatility on the lower timeframes. And this hypersensitivity could affect the output calculation of the indicator.

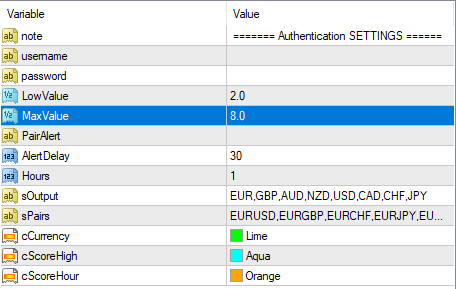

Setting

Here are the important parameters that you can change on your currency strength indicator settings to alter its output.

Note: This only specifies that you are on the settings page.

Username: You may ignore this part without attracting any consequence. You don’t need a username to use this indicator.

Password: The same goes for this part. You don’t need a password to use this indicator.

LowValue: This option has no obvious effect on the output of the indicator.

Maxvalue: Changing this option also has no visible effect on the output of the indicator.

Pair Alert: Put in a currency pair you want to receive alerts on.

Alert Delay: Choose how long it is (in seconds) before an alert rings.

Hours: This option only affects the output of the narrow histogram when you are on any other chart apart from the daily chart. It displays the currency strength ratings of any timeframe you want.

sOutput: These are the currencies whose strength meters are displayed on the chart.

sPairs: Currency pairs the indicator extracts information from.

cCurrency: This is the color every currency is displayed in.

cScoreHigh: This option changes the color of the strength rating before the wide histogram.

cScoreHour: You can change the color of the strength rating before the narrow histogram with this option.

Who is The Currency Power Meter Indicator Best for?

The currency power meter indicator is best for both beginner and expert forex traders because it has a simple interface and it is easy to use. Also, day traders and swing traders would find the indicator useful.