The Cauchy Derivative for MT5 applies the arithmetic mean and the geometric mean and shows the difference between the current and previous bars. It is based on Cauchy’s integral formula for calculating integer values of a holomorphic function. As a result, this indicates a flat or neutral market. Additionally, it provides early warning of upcoming price reversals.

The indicator is easy to use and suitable for both new and experienced Forex traders.

Additionally, traders can apply this indicator on all chart timeframes.

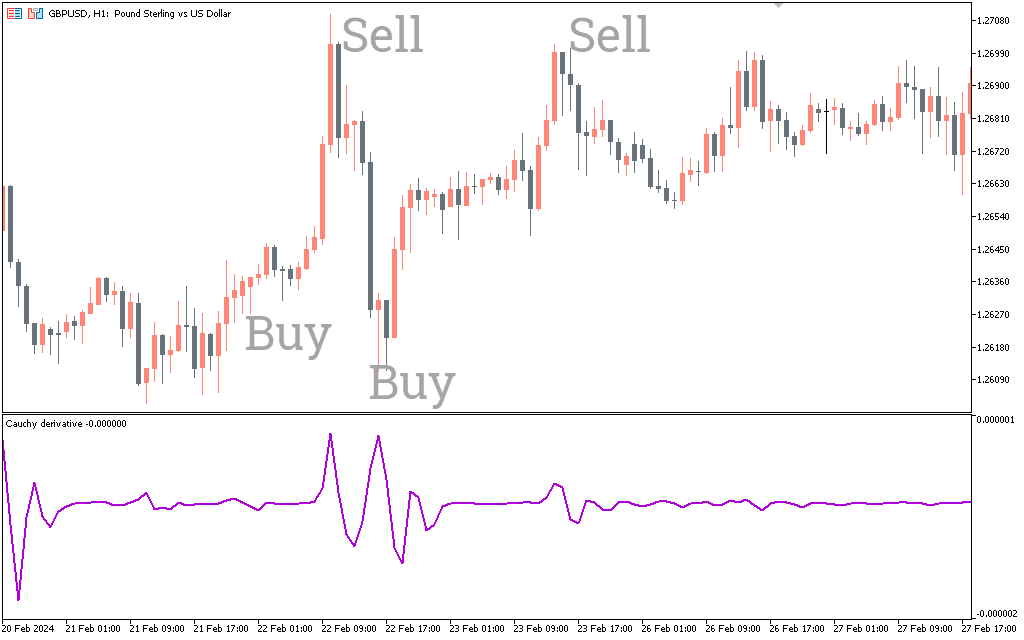

Cauchy Derivative Indicator For MT5 Trade Setup

The indicator draws a purple indicator line and shows the difference in the arithmetic average between the current and previous bar. First of all, the flat line of the indicator indicates a neutral trend in the Forex market. Therefore, traders should refrain from entering the markets during this period.

On the other hand, a jump in values indicates a potential price reversal. Therefore, traders should try to enter trades using price action confirmation. However, traders should only enter if there is a jump in value and refrain from trading the indicator when it is flat.

If the indicator moves sharply higher, traders should enter the market with a buy trade and place a stop loss below the previous swing low. Traders should note that the indicator does not provide a profit target. Therefore, traders are better off using other technical tools to exit or use a good risk-reward ratio.

Traders can use a similar trading strategy and open a sell trade when the indicator peaks downwards.

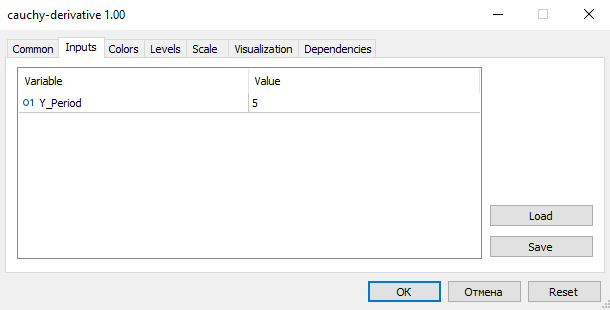

Setting

Y Period: Period for indicator calculation.

Conclusion

Thus, the Cauchy derivative indicator for MT5 helps forex traders to identify flat markets and anticipate trend reversals. However, traders should confirm reversal signals using price action or other technical analysis techniques.