ABCD pattern

Advanced List

- ABCD pattern

- Andrew’s pitchfork

- Average true range (ATR)

- Fibonacci theory

- Ichimoku cloud

- Pivot points

- Three-drive pattern

Fibonacci ratios aren’t just useful for identifying support and resistance levels. They also form the basis of some key chart patterns, including the ABCD.

What is the ABCD pattern?

The ABCD pattern is a visual, geometric chart pattern comprised of three consecutive price swings. It looks like a diagonal lightning bolt and can indicate an upcoming trading opportunity.

This is a valuable pattern to know, as it reflects the rhythmic style in which the markets often move. Essentially, it is made up of four significant highs and lows on the chart:

- A new prevailing trend forms at A

- The market retraces at B

- The initial trend resumes at C

- You can trade the next correction at D

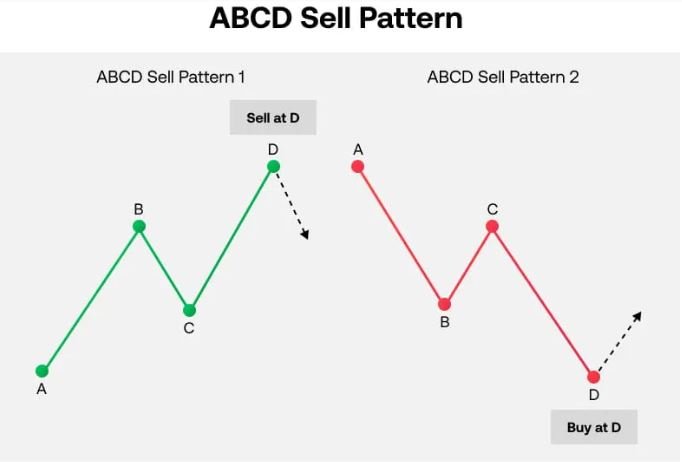

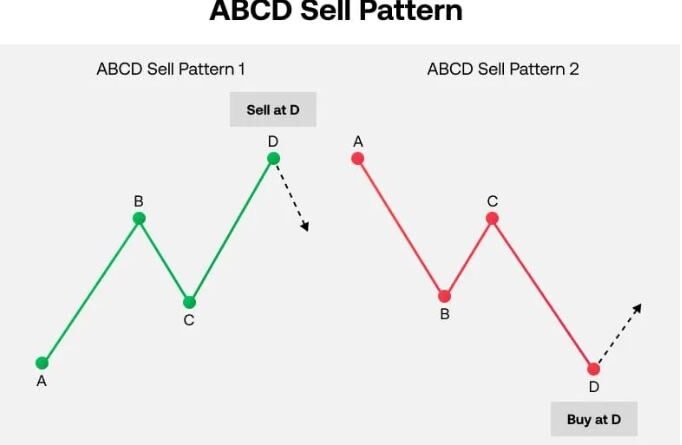

This can appear in both a buy form and a sell form, across any market (including forex, stocks, and more), any condition (rangebound, uptrends, and downtrends), and any timeframe.

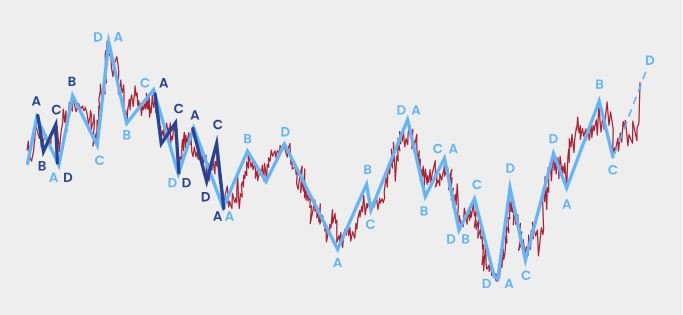

Often, a market’s movement simply repeats the ABCD pattern over time:

In this example, you might notice that some of the patterns converge. This provides a stronger trading signal than a single ABCD pattern in isolation.

Finding the ABCD pattern

To find the ABCD pattern, traders look for the legs or the moves between points. AB and CD denote the moves in the direction of the overall trend, while BC is the retracement.

Each leg typically lasts between three and 13 bars. If you’ve found an ABCD with legs that last longer than 13 bars, you might want to move to a larger timeframe and check for trend/Fibonacci convergence.

If you think you’ve spotted an ABCD, the next step is to use Fibonacci ratios to check that it is valid. This also helps identify where the pattern may be completed, and where to open your position.

In a ‘classic’ ABCD, the BC line should be 61.8% or 78.6% of AB. So, if you use your Fibonacci retracement tool on the initial move from A to B, BC should end at the 61.8 or 78.6 level.

Other ratios

In strongly trending markets, BC may only be 38.2% or 50% of AB.

CD should then be 127.2% or 161.8% of BC. On a bearish ABCD, you might choose to enter a sell position at this point. On a bullish one, you might want to buy the market.

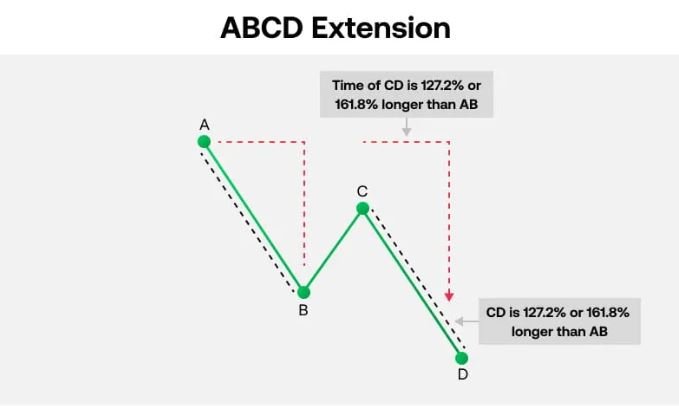

ABCD pattern extension

Sometimes, you might spot an ABCD extension. In this pattern, CD is 127.2% or 161.8% longer than AB instead of BC.

ABCD pattern rules

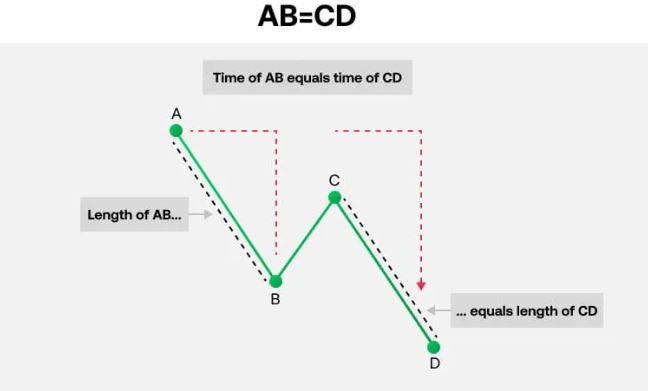

There are a few other rules to follow when finding ABCDs. Firstly, ideally you want the time and length of AB and CD to be roughly equal (unless you have found an ABCD extension).

Additionally:

- In the move from A to B, the market should not go beyond either A or B

- In the move from B to C, the market should not go beyond either B or C

- In the move from C to D, the market should not go beyond either C or D

- In a bullish ABCD, point C must be lower than A and D must be lower than B

- In a bearish one, C must be higher than A and D must be higher than B

Bullish ABCD Pattern Rules

1. Find AB

a. Point A is a significant high

b. Point B is a significant low

c. In the move from A to B there can be no highs above point A, and no lows below B

2. If AB, then find BC

a. Point C must be lower than point A

b. In the move from B up to C there can be no lows below point B, and no highs above point C

c. Point C will ideally be 61.8% or 78.6% of AB

i. In strongly trending markets, BC may only be 38.2% or 50% of AB

3. If BC, then draw CD

a. Point D must be lower than point B (market successfully achieves a new low)

b. In the move from C down to D there can be no highs above point C, and no lows below point D

c. Determine where D may complete (price)

i. CD may equal AB in price

ii. CD may be 127.2% or 161.8% of AB in price

iii. CD may be 127.2% or 161.8% of BC in price

d. Determine when point D may complete (time) for additional confirmation

i. CD may equal AB in time

ii. CD may be 61.8% or 78.6% time of AB

iii. CD may be 127.2% or 161.8% time of AB

4. Look for fib, pattern, trend convergence

5.Watch for price gaps and/or wide-ranging bars/candles in the CD leg, especially as market approaches point D

Traders may interpret these as signs of a potential strongly trending market and expect to see 127.2% or 161.8% price extensions

Bearish ABCD Pattern Rules

1. Find AB

a. Point A is a significant low

b. Point B is a significant high

c. In the move from A up to B there can be no lows below point A, and no highs above point B

2. If AB, then find BC

a. Point C must be higher than point A

b. In the move from B down to C there can be no highs above point B, and no lows below point C

c. Point C will ideally be 61.8% or 78.6% of AB

d. In strongly trending markets, BC may only be 38.2% or 50% of AB

3. If BC, then draw CD

a. Point D must be higher than point B

b. In the move from C up to D there can be no lows below point C, and no highs above point D

c. Determine where D may complete (price)

i. CD may equal AB in price

ii. CD may be 127.2% or 161.8% of AB in price

iii. CD may be 127.2% or 161.8% of BC in price

d. Determine when point D may complete (time) for additional confirmation

e. CD may equal AB in time

f. CD may be 61.8% or 78.6% time of AB

g. CD may be 127.2% or 161.8% time of AB

4. Look for fib, pattern, trend convergence

5. Watch for price gaps and/or wide-ranging bars/candles in the CD leg, especially as market approaches point D

Traders may interpret these as signs of a potential strongly trending market and expect to see 127.2% or 161.8% price extensions

Trading with the ABCD pattern

To find an ABCD pattern on your trading chart, follow these six steps:

- Log into your trading account and open a market’s chart

- Find AB. Remember that this move must be entirely contained within A and B

- Find BC. This retracement should reach 61.8% or 78.6% of the move from A to B

- Draw CD. Using the AB and BC lines, you should be able to predict where point D will land. CD will usually be equal to AB, and 127.8% or 161.8% of BC in both price and time

- Watch for price gaps and wide-ranging bars in the CD leg. These can indicate that an extension is forming, so CD could be longer than AB

- Trade the potential retracement at D. Open a sell position if you’ve found a bearish ABCD, or buy if you’ve found a bullish one

ABCD pattern factsheet

| Type: | Pattern |

| Used in: | Any conditions |

| Used for: | Finding opportunities |

| Markets: | Any |

| Timeframes: | Any |

Pingback: Andrew’s pitchfork – EasyPips

Pingback: Fibonacci theory – EasyPips

Pingback: Ichimoku cloud – EasyPips

Pingback: Pivot points – EasyPips