Master FX With the TDI Indicator

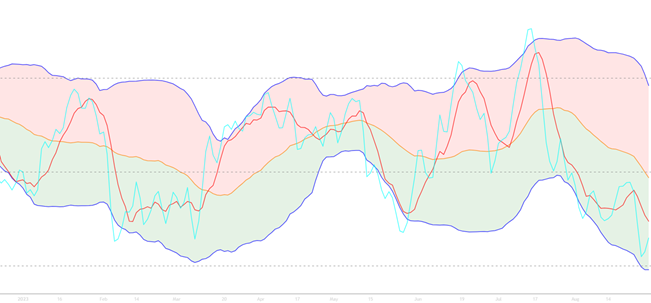

This TDI Indicator (Traders Dynamic Index indicator) is a powerful tool that combines three RSI indicators with Bollinger Bands to give you precise entries and help you stay in trades until a trend reversal occurs.

It works on any market and timeframe, giving you a consolidated view of market sentiment, volatility, and momentum.

The Power of the TDI Indicator

The TDI indicator allows you to “cheat the market” by providing fairly precise entries for trading, giving you an edge over other traders.

This indicator combines three RSI indicators with Bollinger Bands, simplifying your trading process and reducing confusion. The TDI indicator also helps you maximize your profits by providing clear signals and keeping you in trades until a trend reversal occurs.

By studying the TDI indicator’s green line, which represents market sentiment and movement, you can gain a deeper understanding of the current market conditions. Additionally, the yellow line indicates the overall market direction.

With its consolidated view of market sentiment, volatility, and momentum, the TDI indicator is a powerful tool for traders looking to cheat the market and increase their profits.

Unlocking the Potential of the TDI Indicator

To unlock the full potential of the TDI strategy, you should focus on understanding the different lines and their significance in determining market sentiment and direction.

Here is a table that summarizes the different lines and their meanings in the TDI indicator:

| Line | Meaning |

|---|---|

| Green Line | Represents market sentiment and movement |

| Yellow Line | Shows the overall market direction |

| Red Line | Indicates buyers stepping into the market |

| Signal Line | Provides confirmation of trend alignment |

| Base Line | Represents price movement |

Step-by-Step TDI Trading Strategy

To execute the TDI trading strategy successfully, follow these step-by-step instructions.

Look for the red line breaking above the yellow line, indicating buyers entering the market.

Confirm alignment between short-term and long-term trends by observing the green line breaking above the yellow line. WARNING: We do not want to see the red line breaking above the upper band when looking to buy.

Buy at the closing candle after this confirmation. We are seeing buying entering the currency pair that is not overextended. We look for extension when the red line breaks above the upper band.

Set a protective stop loss below the swing low caused by the red line crossing above the green line.

Profit levels are objective. Exit your position when the red and green lines cross over the 70 level. If the lines approach the level and then fade, use the closest swing low to move up your stop. No need to risk all the gains when you were close to your targets.

The TDI strategy simplifies trading by combining multiple indicators into one, providing clear signals as well as objective entry and exit rules.

TDI: A Versatile Tool for Any Market

Unlike other indicators that may focus on a specific aspect of trading, the TDI indicator provides a consolidated view of market sentiment, volatility, and momentum.

This perspective simplifies trading by combining multiple indicators into one, eliminating the need for traders to use different tools for different purposes.

The TDI indicator can be used on any market and timeframe, allowing traders to adapt their approach to various trading conditions.

In comparison to other indicators, the TDI stands out as a versatile and effective tool for achieving consistent profitability (potential) in the forex market.

Staying in Profitable Trades With TDI

Now that you understand the versatility of the TDI indicator, let’s see how it can help you stay in profitable trades and maximize profits. By using the TDI indicator effectively, you can ensure that you make the most out of every trade.

Here are some key points to consider:

- Identify strong market sentiment: The TDI indicator’s green line represents market sentiment and movement. By monitoring this line, you can gauge the strength of the current trend and make informed trading decisions.

- Confirm alignment of short-term and long-term trends: When the green line breaks above the yellow line, it confirms that the short-term and long-term trends are aligned. This is a strong signal to enter a trade and stay in it for maximum profit potential.

- Set protective stop loss: To protect your capital, set a stop loss below the swing low caused by the red line crossing above the green line. This will limit your losses in case the market reverses.

- Take profit at appropriate levels: When both the red and green lines cross above the 70 level, it indicates an overbought condition. This is a good time to take profit and exit the trade.

- Continuously monitor market conditions: The TDI indicator helps you stay in trades until a trend reversal occurs. Continuously monitor the market conditions and adjust your trading strategy accordingly to maximize your profits.

Frequently Asked Questions

What Are the Potential Risks or Drawbacks of Using the TDI Indicator for Trading?

The potential drawbacks of using the TDI indicator for trading include false signals during choppy markets and reliance on historical data. However, the TDI indicator can be effective in different market conditions if used with proper risk management and confirmation from other indicators.

Can the TDI Indicator Be Used for Long-Term Investing or Is It Primarily for Short-Term Trading?

The TDI indicator is primarily designed for short-term trading, but it can also be used for long-term investing. Its effectiveness in the long run depends on market conditions and the trader’s ability to adapt the strategy.

How Does the TDI Indicator Account for Market Volatility and Sudden Price Movements?

The TDI indicator takes into account market volatility and sudden price movements by providing a consolidated view of market sentiment, volatility, and momentum. While there are risks involved, it can be used for long-term investing.

Are There Any Specific Market Conditions or Scenarios Where the TDI Indicator May Not Be as Effective?

The TDI indicator may be less effective in volatile market conditions or during sudden price movements. These scenarios can create false signals and make it challenging to accurately gauge market sentiment and direction.

Are There Any Alternative Indicators or Strategies That Can Be Used With the TDI Indicator for Even Better Results?

Yes, there are alternative indicators and complementary strategies that can be used in conjunction with the TDI indicator for even better results. These can include the use of other oscillators or trend-following indicators to confirm signals and improve trading accuracy.

Conclusion

This versatile and powerful tool will help you master the FX market. By understanding market sentiment and following the step-by-step trading strategy, you can simplify your trading and maximize your profits.

Entering trades when the green line breaks above the yellow line. Set protective stop losses and stay in profitable trades until a trend reversal occurs. The TDI Indicator is an objective way to tackle any FX pair.